With today’s strong economy, consumers are trading up in the deli. This is the perfect opportunity for the department to raise the bar and get into the game with charcuterie.

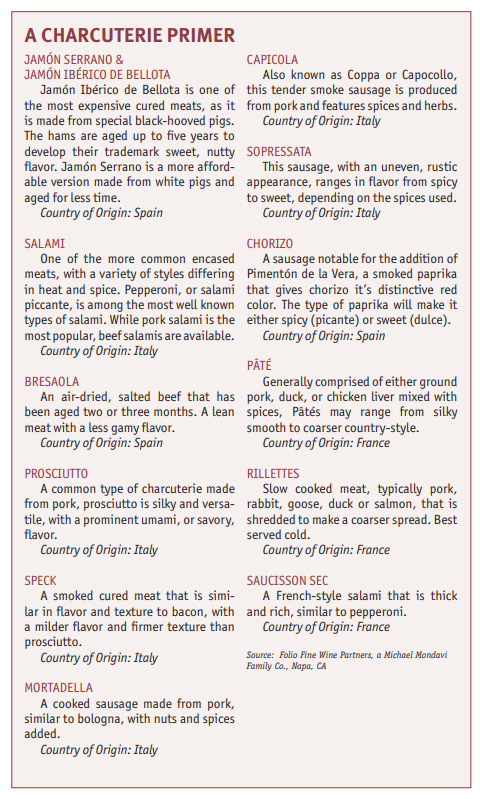

Derived from the French term ‘chair cuit’, which translates into ‘cooked flesh’, charcuterie encompasses cured and preserved meats, including bacon, sausage, ham, pâté and terrine.

According to recent statistics from the Chicago-based Nielsen Perishables Group, dollar and volume growth from the specialty deli meat segment account for $200 million in supermarkets’ deli and meat departments. Specialty deli meat overall dollar sales grew by more than 3 percent in the year ending February 25, 2017. Chorizo led the pack, with dollar sales up more than 7 percent. Other top-selling varieties were salami, up 3.3 percent in dollars and 2.8 percent in volume; pepperoni, growing 4.1 percent in dollars and 5 percent in volume; and sausage, which increased 1.8 percent in dollars, but was flat in volume.

“We’re definitely seeing more consumers seeking authentic charcuterie products,” says Scott Fegler, senior manager, business development, at Atalanta Corp., headquartered in Elizabeth, NJ. “We’re starting to see a lot of awareness, specifically within this segment, that there are other countries of origin aside from Spain and Italy.”

The Products

Although Italy and Spain are known for their charcuterie, think chorizo and prosciutto, Eastern European counties such as Germany are getting into the mix with their versions of prosciutto and speck.

“Consumers are craving new products, and these have a more smoked and dry aged flavor profile than typical Italian type hams and salamis,” says Fegler.

Not only are these Eastern European meat specialties being marketed for charcuterie boards, but these products also are being incorporated in authentic dishes from the region.

“Another trend we’re seeing is a bigger focus on specific breed types and country of origin, since there is more consumer awareness,” says Fegler. “Both the upscale and [more pedestrian] types of charcuterie are growing.”

Another development is the prevalence of dry-cured sausage, which has become more of a staple in supermarket deli grab-and-go sections.

“Consumers can find many interesting flavors incorporated into the product or dry rubbed on the outside,” says Alexandra Groezinger, vice president of Alexian Pâtés, based in Neptune, NJ. “It really makes a nice addition to a charcuterie board. I am also seeing packs of sliced sausage or deli meats in the specialty cheeses and meats sections of the deli, whereas sliced meats were predominantly in a different area of the store.”

Alexian offers 20 different flavors of all natural pâtés as well as a line of European-style smoked meats and sausages as part of its charcuterie line. Its pâtés are free from preservatives, additives and artificial ingredients, with no hormones or antibiotics.

“Our pâtés range anywhere from the traditional country style pâtés to the softer, more spreadable mousse, to vegetable and vegan varieties,” says Groezinger. “Alexian is family owned, and our recipes are deeply rooted in our European heritage, as they originate from the sausage makers and charcuterie masters in our family tree.”

With the holidays quickly approaching, timing is key for charcuterie, as this is when consumers are seeking variety and entertaining ideas.

“People are looking for something different in the last quarter, and duck tends to be seasonal,” says Sebastien Espinasse, who handles sales and marketing at Hayward, CA-based Fabrique Delices.

The company sells duck pâtés, duck prosciutto and other duck cured meats. The company recently introduced a new mousse snack pack and is working on creating charcuterie boards that include pâté, crackers and olives.

“We eat duck regularly in Europe, but in the U.S., it’s more of a delicacy and popular during the holiday months,” says Espinasse.

At Les Trois Petits Cochons – Three Little Pigs, headquartered in Brooklyn, NY, the company offers charcuterie lines in chubs and flavored slices.

“Ours is a French style, with a mix of herbs from the south of France,” says Morgane Huet, marketing associate. “We’re always coming up with new flavors with our lines.”

Mirroring the trend of plant-based foods, there also are vegan charcuterie options available.

“The flavor is not quite there with these products,” says Espinasse. “Instead, the focus is on the meat, including its origin, ingredients and production methods. The trend is to stay authentic, artisanal and true to the flavor of the product, while not cutting corners with the quality.”

The Promotions

Charcuterie is most often thought of as an appetizer component that’s paired with cheeses, crackers, maybe imported olives, dried fruits and nuts. Yet, it pays to think outside of the box.

Although the majority of charcuterie is geared for grab and go areas of the store, some supermarket delis have incorporated these items into their catering and prepared food programs.

“In the last quarter, retailers are looking for something special to bring more attention to their departments,” says Espinasse. “Charcuterie meats are pricier than everyday items, so consumers will spend more in the last couple months of the year on these types of products.”

In terms of pairings, the flavor of charcuterie can be enhanced with different beverages, such as wine, beer or cider.

“When we develop a product for this market, we do a lot of pairings to ensure the meat flavor doesn’t conflict,” says Espinasse. “It needs to be balanced.”

A well-organized and well-rounded charcuterie platter can be a show stopper and a conversation starter.

“Many are intimidated by the idea of putting one together, so supermarkets could really capitalize on the opportunity to make charcuterie platters for the customer,” says Groezinger at Alexian Pâtés.

It also helps to provide insight on usage and pairings.

“Our labels are in French, so it can be confusing as to what to do with charcuterie,” says Huet at Les Trois Petits Cochons. “Beautiful photos that show charcuterie slices on a baguette with cochons or in a sandwich can help.”

New packaging innovations have made charcuterie more accessible as a snack.

“Snacking is trending right now, so brands are creating snack sized bites of their products or making a partner pack of items that complement each other,” says Groezinger at Alexian Pâtés.

The increasing number of size variations and formats also have expanded the marketplace and demographic for these higher end products.

“We now have chubs and sliced product that is shelf stable,” says Huet at Les Trois Petits Cochons. “Because these items don’t need to be refrigerated, it is easier for supermarkets to merchandise the products anywhere in the department.”

Although the packaging emphasizes convenience, it cannot forsake presentation in the process.

“Right now, there are more snack packs out there and everything is prepackaged, but there is more plastic than product inside,” says Espinasse at Fabrique Delices. “Everyone wants added convenience, but at the end of the day this means more plastic in the sea.”

In spite of the environmental implications, consumers are seeking authentic products in a grab-and-go format, and this is impacting product delivery in the charcuterie segment.

“Salami whips have become more popular,” says Fegler at Atalanta. “This is similar to a meat stick, with dried salami that’s aged 28 days. It’s called ‘kabanos’ and is a single-serve item. New pack sizes and formats, along with presliced charcuterie, is big, but the future of this segment continues to upscale.”

It remains to be seen what impact the recent African swine flu epidemic will have on the segment over the long term. In the short term, it has strained charcuterie supplies this past year.

“This is the largest animal disease in modern history, with 100 million pigs in China killed due to this disease,” says Fegler. “Supply has been strained since earlier this year, but is getting worse every month, and the virus has spread to other countries, including southeast Asia and South Korea.”

This is expected to drive charcuterie prices up and impact the market for the next two to three years.

“Next year, we may see an increase in raw material prices that will further put a strain on the category,” says Fegler. DB